Hard Money Georgia - Truths

The 45-Second Trick For Hard Money Georgia

Table of ContentsAll about Hard Money GeorgiaThe Ultimate Guide To Hard Money GeorgiaThe Hard Money Georgia PDFsSee This Report about Hard Money Georgia

The maximum appropriate LTV for a difficult cash funding is commonly 65% to 75%. On a $200,000 house, the optimum a difficult cash lender would be prepared to offer you is $150,000.

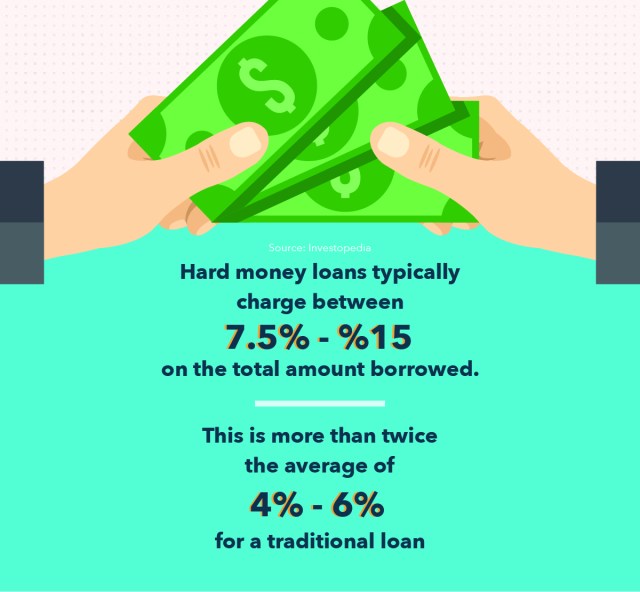

By contrast, passion prices on difficult cash car loans start at 6. Difficult cash lending institutions usually charge points on your lending, often referred to as source fees.

Points are usually 2% to 3% of the financing quantity. Three points on a $200,000 finance would be 3%, or $6,000. hard money georgia. You might have to pay even more points if your finance has a higher LTV or if there are numerous brokers entailed in the deal. Some lenders bill only factors and no other fees, others have additional prices such as underwriting fees.

Some Ideas on Hard Money Georgia You Should Know

You can expect to pay anywhere from $500 to $2,500 in underwriting fees. Some difficult cash loan providers also charge prepayment fines, as they make their cash off the passion charges you pay them. That means if you settle the car loan early, you may need to pay an additional cost, including in the financing's cost.

This suggests you're more probable to be offered funding than if you applied for a traditional home mortgage with a suspicious or thin credit report history. If you require money promptly for restorations to turn a home commercial, a hard cash funding can give you the cash you need without the problem and documentation of a standard home mortgage.

It's an approach capitalists make use of to get investments such as rental residential properties without making use of a whole lot of their own possessions, and hard money can be helpful in these situations. Although hard cash finances can be useful for genuine estate investors, they need to be used with caution specifically if why not try here you're a beginner to real estate investing.

With shorter settlement terms, your regular monthly repayments will be much more costly than with a normal home mortgage. If you fail on your finance settlements with a tough cash lending institution, the consequences can be severe. Some fundings are personally guaranteed so it can damage your debt. As well as since the financing is safeguarded by the property in question, the lending institution can take belongings and confiscate on the home due to the fact that it functions as security.

What Does Hard Money Georgia Do?

To find a reliable lending institution, talk with relied on realty representatives or home mortgage brokers. They might be able to refer you to lending institutions they've collaborated with in the past. Tough cash lending institutions also typically attend real estate investor meetings to make sure that can be an excellent location to get in touch with lenders near you.

Equity is the value of the property minus what you still owe on the home mortgage. The underwriting for residence equity car loans likewise takes your credit score background and earnings into account so they have a tendency to have lower interest rates and also longer repayment durations.

When it comes to moneying their following bargain, genuine estate capitalists and also entrepreneurs are privy to several providing choices basically made for real estate. Each comes with particular requirements to access, as read the full info here well as if used appropriately, can be of significant benefit to financiers. Among these lending types is tough money lending.

It can likewise be labelled an asset-based lending or a STABBL finance (temporary asset-backed bridge loan) image source or a bridge finance. These are derived from its characteristic temporary nature and the demand for substantial, physical collateral, usually in the form of actual estate home.

What Does Hard Money Georgia Mean?

As a result, requirements may vary significantly from loan provider to loan provider. If you are looking for a financing for the very first time, the approval procedure could be relatively rigid and you might be called for to provide additional details.

This is why they are mainly accessed by property business owners that would typically need fast funding in order to not miss out on warm possibilities. In addition, the loan provider mostly thinks about the value of the property or home to be bought rather than the debtor's personal money background such as credit report or revenue.

A conventional or financial institution lending may use up to 45 days to close while a hard cash car loan can be shut in 7 to 10 days, in some cases faster. The comfort and rate that hard cash car loans supply stay a major driving pressure for why investor pick to use them.